Salford businesses may have an uncertain future ahead of them as the international reaction to the Prime Minister’s new ‘mini budget’ decimates the pounds value amid spiralling inflation.

Within the first 3 weeks of Liz Truss’ premiership the new PM has already radically changed her party’s economic policy from Johnson’s previous ‘one-nation’ approach to conservatism, opting instead for a restyling of ‘80s fiscal policy.

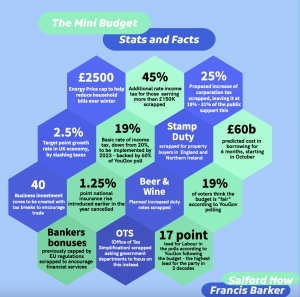

The controversial new budget that was proposed by Kwasi Kwarteng, the Chancellor, looks to reverse the proposed corporation tax hike of 25 per cent, instead keeping it at 19 per cent, a policy that YouGov suggests only 31 per cent of the country supports.

Credit: Francis Barker

Anrfi Bak, owner of The Horsebox Café on Worsley Green, spoke about the budgets effect on his new business. He said: “I do personally believe it’s going to help thousands of businesses in terms of tax but we don’t know how it will impact the national economy in the longer run.

“As we all know, especially through Covid, so many small businesses couldn’t survive and had to close their doors, so this hopefully might give them a chance to return to trading.”

The mini budget aims to stimulate the economy by a 2.5 per cent trend of growth, hopefully, encouraging growth in businesses by leaving taxes low.

However, with rising energy bills, inflation wavering between 12 – 14 per cent and the pound falling to its lowest value since the 70s, many local businesses will still face a tough winter.

Truss has suggested that the ‘mini budget’ will reduce tax burden on families throughout the country, giving more families more to spend. Despite this, it has been heavily criticised by Salford politicians for disproportionately impacting poorer and middle-income families while those in the top 5 per cent of earners will gain significantly more money.

So while the poorest households gain only £90 on average, the middle fifth of households lose £780 and the top five percent gain £2,250 from this Conservative Government’s tax and benefit policies.

Redistribution to the richest. https://t.co/ehrLBlNo2A

— Barbara Keeley 💙 😷🇺🇦 (@KeeleyMP) September 24, 2022

Executive Support Member for Skills, Work & Business on Salford City Council and Labour Councillor, Philip Cusack, said: “It’s a budget for the rich. It’s not a budget for the majority of people in need from Salford.

“I’m disappointed. I’m more than disappointed. The government hasn’t taken the opportunity that it could have taken to address the some of the issues facing the majority of people from Salford who are struggling with energy bills, many of whom even struggle to feed themselves.

“I think it will have minimal effect on ordinary people. It will primarily affect those very much in the upper tax band, primarily £155 thousand per year, which is not a typical wage or income of families.”

Credit: Francis Barker

Salford, along with 8 other Greater Manchester boroughs, have had a deeper recession than the national UK average since the 2008 financial crash. This means that, according to research conducted by the University of Manchester, Salford’s economy has risen disproportionately to the rest of the country.

Since 2008, Salford saw a GDP decline of -4.5 per cent that only recovered to pre-2008 records by 2012. Salford also saw some of the most drastic unemployment of the Greater Manchester boroughs losing -6.05 per cent of employment at its peak compared to the national average of -1.59 per cent. Only Tameside, Stockport and Oldham fell lower.

The austerity measures that followed the finical crisis also reduced Salford’s real terms weekly earnings to a trough of -10.63 per cent in 2011, a figure that is yet to reach pre 2008 levels.

This coupled with the devastating economic impact of the Covid19 pandemic means Salford is already an area of the country that has seen minimal growth. This will likely have a major knock-on effect to businesses, families and public services in the borough, unless Kwarteng and Truss’ risk-taking budget, paired with an adequate ‘levelling up scheme’ produces the growth they’ve promised it will.

Samantha McDermott, a senior NHS nurse in Salford said: “I Don’t think it’s fair that the budget is only beneficial to those who earn over a certain amount. That doesn’t include myself or any of my NHS colleagues.

“It’s not the money that offends me, in terms of how much people earn, but I do think that the government seems to be valuing the people who are at the top end of the wage scale and the people in the financial industry, rather than other industries in this country that keep it going.

“This budget and the impact it will have on people’s wages is leading to more and more people leaving health and social care.”

Recent Comments